When you open the template, you’ll notice the current month is set to March 2020. The more data you categorize, the clearer picture you’ll see.

Now you should categorize your recent transactions.

Use this help doc to review your options. There are a few ways to manually import your bank data.

#Free budget software with auto account manual#

No more manual data entry, cutting and pasting, or CSV files. Not only will Tiller Money Feeds import your past bank, credit card, and other financial transactions, it automates them into your budget spreadsheet. The easiest way to add your own data is with Tiller Money Feeds. There are several ways to get your transactions into this template. You can delete this data and use your own.

#Free budget software with auto account free#

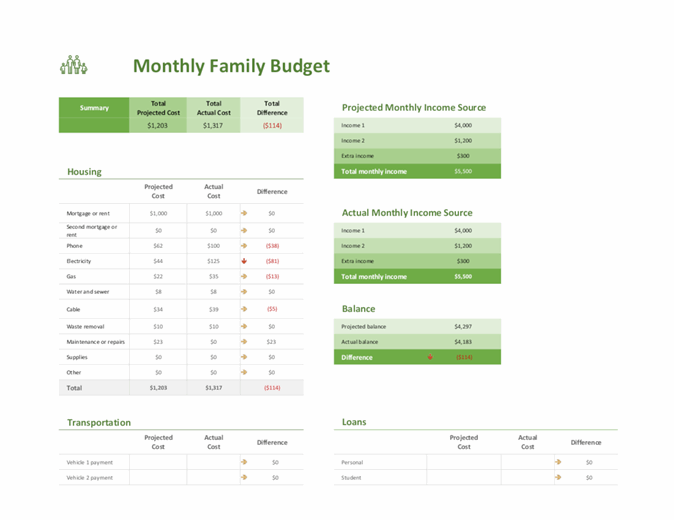

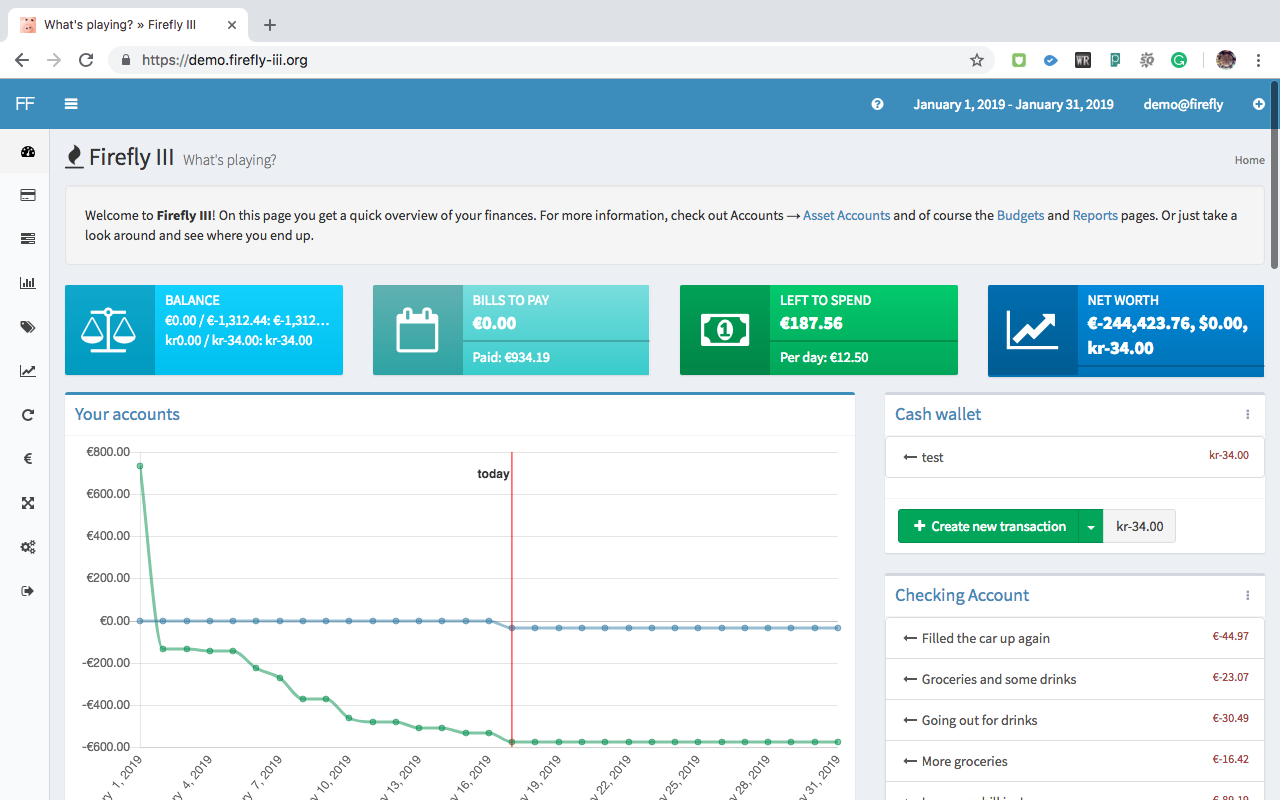

The free Monthly Budget Spreadsheet comes with sample transaction data so you can see how it works. Import or add your financial transactions to the Transactions sheet For example, you might plan to spend more in your “Travel” category in the summer and less in the winter. However, you can manually adjust budget amounts in each individual month as needed. Whatever number you input for January will automatically be used for the following months. In the Categories sheet, set your planned (budgeted) income, spending, and transfer amounts in each of the categories you created in step 1. Set your preferred monthly budget amounts Here’s a great thread in the Tiller Money Community where people share their budget and tracking categories. The ability to create custom categories that reflect how you think about your money is one of the greatest benefits of budgeting in a spreadsheet. The categories you create here are used in the Yearly Budget and Monthly Budget sheets. You can add, delete and rename your categories in the Categories sheet. Insights sheet with personalized charts to help you better understand your financial trends.Yearly budget sheet to plan your year in one place.This easy-to-use free template includes the following sheets: To help more people budget with the benefits of a spreadsheet, Tiller Money has created a free, non-automated version of our Foundation Template for Google Sheets. Spreadsheets are uniquely useful tools for making and tracking your budget. It allows us the opportunity to see the gap between what we say is important to us and how we spend our money.” – Carl Richards Use This Free Monthly Budget Template to Manage Your Money “Budgeting forces us to face the reality of how we spend. (Use this free 50/30/20 budget calculator to figure this out.) Financial experts recommend 20% of your income should go toward eliminating debt and saving for emergencies and then retirement. Savings and debt reduction goals– Beyond expenses, it’s important to budget for short and long term savings.Variable expenses such as property tax payments, holiday gifts, and vacations fluctuate month to month. Your expenses – Fixed expenses include housing, food, car payments, and student loans.Your income – After all sources of income are tallied, and after taxes and other mandatory payments are deducted, how much are you actually bringing in each month?.In terms of the numbers that will help you make a budget, you need to know: We’ve previously noted that the three steps to get started with any personal budget program are: Want to feel financially organized in less than thirty minutes? No problem: make a plan for your money with a monthly budget that will help you track expenses and prioritize where your money goes.

0 kommentar(er)

0 kommentar(er)